|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

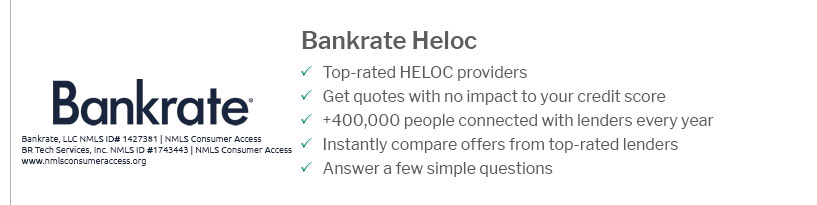

Best HELOC Rates in Dallas: A Comprehensive Guide for Savvy BorrowersWhen considering a Home Equity Line of Credit (HELOC) in Dallas, understanding the best rates is crucial. In this guide, we explore how you can secure favorable terms, factors influencing rates, and expert tips to make informed decisions. Understanding HELOC BasicsA HELOC allows homeowners to borrow against the equity of their home, offering flexibility and potential tax benefits. But what exactly determines the rates you might be offered? Factors Influencing HELOC Rates

Comparing LendersComparing offers from multiple lenders is a smart move. Consider both local Dallas banks and national institutions. Each lender may provide different terms and incentives. Steps to Secure the Best RatesEvaluate Your Financial HealthBegin by assessing your credit score and financial standing. This evaluation will give you a clear picture of your bargaining power when negotiating rates. Shop AroundDon't settle for the first offer. Take time to explore different lenders. Use online resources to compare rates and terms. For instance, understanding the home loan pre approval cost can aid in budgeting for your HELOC. Negotiate TermsOnce you've found potential lenders, use your financial health as leverage to negotiate better terms. Ask about any discounts or promotional rates they may offer. Making an Informed DecisionSecuring a favorable HELOC rate involves more than just the numbers. Consider the following tips:

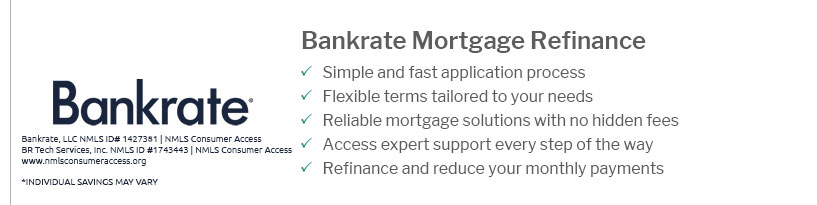

For those considering refinancing, exploring options like mortgage refinance houston can also offer insights into better financial strategies. FAQs About HELOC Rates in DallasWhat is a competitive HELOC rate in Dallas?A competitive HELOC rate in Dallas typically ranges between 3% to 7%, depending on factors like credit score and LTV. How can I improve my chances of getting a lower rate?Improving your credit score, reducing your LTV, and shopping around for different offers can enhance your chances of securing a lower rate. Are there any risks associated with HELOCs?Yes, risks include variable interest rates, potential fees, and the possibility of losing your home if you default on payments. https://www.premieramerica.com/borrow/home-loans/home-equity-loans

The APR for a Home Equity Line of Credit is variable and based on the Prime Rate as published in the Wall Street Journal, credit score tier, plus margin and ... https://www.lendingtree.com/home/home-equity/heloc/

The best HELOC lenders of 2025 - Best HELOC for high loan amounts: Flagstar Bank - Best HELOC for quick closing: Rate - Best for HELOCs with no ... https://www.erate.com/texas/dallas-home-equity-line-lenders

Our goal is to provide an extensive network of home equity lenders throughout the Dallas area. Scroll down to see current home equity rates from other Texas ...

|

|---|